Pay by Card, but Watch Out for Foreign Transaction Fees If you can plan ahead, try to avoid airport kiosks and other exchange counters in heavily touristed areas-their business is based on charging extra for being a convenient, last-minute option. If you are traveling on short notice and need some foreign currency in cash at the airport, then it could be worth paying the extra costs for the sake of convenience. If you had made that exchange back at your home bank, you’d have an additional £5 in your pocket.Īirport kiosks may also charge higher fees, which sometimes are hidden within the poorer exchange rates they offer for converting your dollars to euros, pounds, pesos or another currency. These places offer convenience, but their exchange rates are typically much less favorable than your bank at home.įor example, if you are traveling to the United Kingdom and your bank would have given you an exchange rate of £72 per $100, the airport kiosk may give you only £67 per $100, costing you extra money in the form of fewer pounds for your dollar. If you don’t have time to get cash at the bank before your trip, it can be tempting to get foreign currency at an airport kiosk or currency exchange counter. Avoid Currency Exchange Kiosks at Airports

#Best free currency converter app 2021 plus

“For example, Bank of America Preferred Rewards members receive a discount of up to 2% on online and mobile foreign currency orders, plus free standard shipping,” he says. “By ordering your currency in advance through your bank, you may also qualify for extra perks or benefits,” says Sellers. “As these rates are constantly changing, Bank of America uses a variety of factors to determine its exchange rate-including market conditions and rates charged by other financial institutions,” he says.ĭepending on where you do your banking and your overall relationship with them, you may qualify for special rewards or perks on foreign currency exchange. “Customers who order currency through their own bank can ensure the money they receive is authentic and that they have received the best, legal rate,” says John Sellers, rewards executive at Bank of America. If you can plan ahead, there’s a good chance you can get cash at a more favorable exchange rate by dealing directly with your bank in the U.S. Other less frequently requested currencies could require a few days of advance notice or longer. Depending on your bank, where you live and which country’s currency you need, some currencies may be available for same-day exchange. You may be able to get currency in cash at your local bank branch, or order currency online or by phone to be delivered to your home. For example, Wells Fargo offers 70 currencies for use in more than 100 countries, and Bank of America exchanges currencies for more than 100 countries.

banks will have foreign currency available to sell to you. Depending on which country (or countries) you’re visiting, most major U.S. One of the best ways to minimize currency exchange fees is to get some cash from your bank or credit union in the U.S. Get Cash at Your Bank Before Leaving the U.S.

#Best free currency converter app 2021 how to

Here are a few tips and insights on how to enjoy your international travels while minimizing currency fees. In general, some methods of getting cash and making purchases will give you a better deal than others when you’re ready to take your next international trip. But, if you’re not careful, you could end up paying more than you bargained for. It can also be exciting to see and use the colorful foreign banknotes and interesting coins that you may not experience in your everyday life.

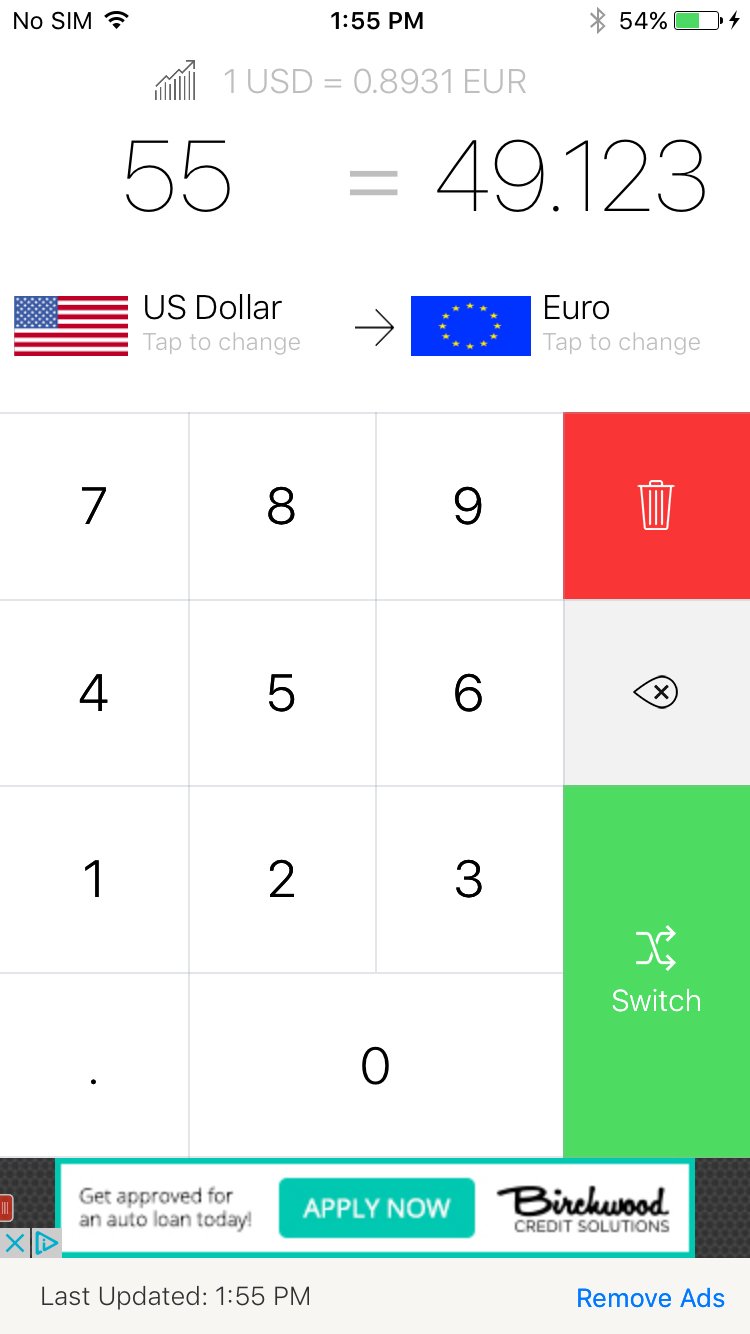

The prices at stores and restaurant menus may not feel as real as they do in U.S. At least in part, this is because spending money in foreign currency may feel different. Of course, it can be easy to overspend in a foreign country. One bank, merchant or currency exchange location could give you a slightly better deal on currency exchange rates, just based on the daily ups and downs of the markets. Currency exchange rates are complicated and are constantly fluctuating as part of the everyday rush of global commerce. Undeniably, when traveling internationally, it’s important to watch out for currency exchange conversion fees, foreign transaction fees and other costs.

If your next vacation is going to take you to another country, you may want to know how to get foreign currency without paying extra fees. Americans are getting ready to travel again as part of the pent-up consumer demand from the pandemic.

0 kommentar(er)

0 kommentar(er)